Should Contractors Purchase or Lease Trucks for Business? [Cost Example]

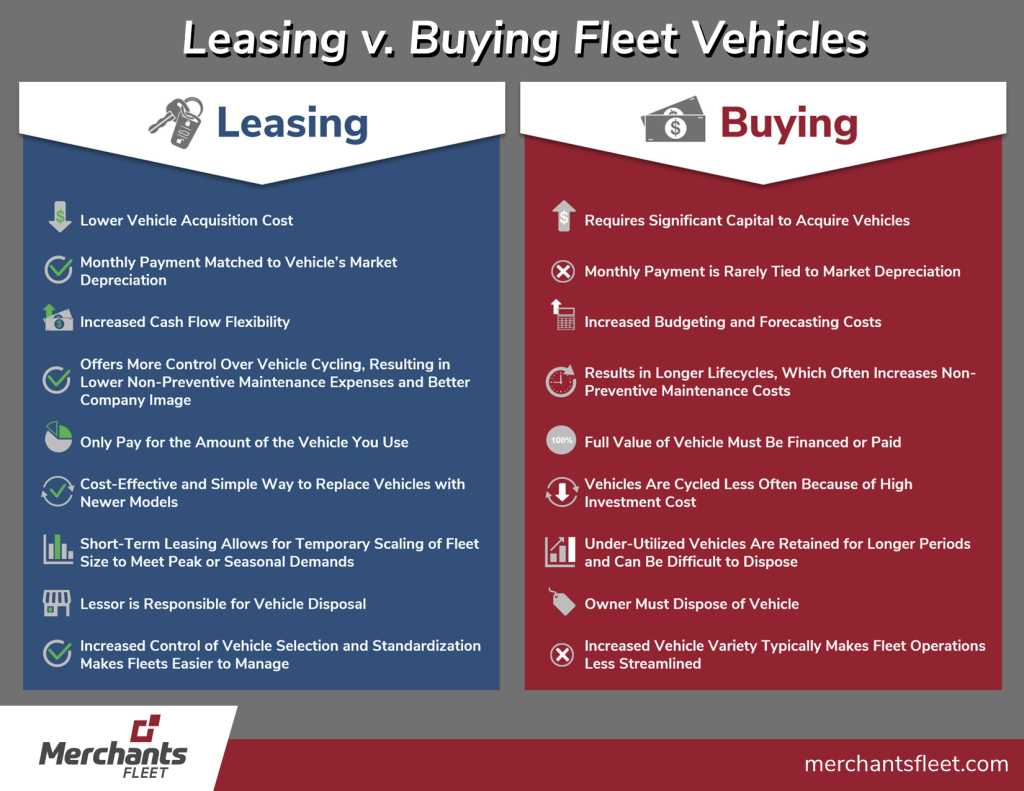

On the fence about leasing trucks for your business? Both purchasing and leasing have their benefits, but your decision should ultimately depend on what you need, your finances, and several other factors.

Read on to get the scoop on truck fleet management and your leasing and purchasing options.

What Commercial Trucks Do You Need?

What Are Your Truck Leasing & Purchasing Options?

The 7 Biggest Benefits of Leasing Trucks for Business Use

Truck Leasing vs. Purchasing [Example]

What Commercial Trucks Do You Need?

Before we get into the different leasing and purchasing options, it is necessary to consider the types of vehicles you need.

The price of these trucks will vary greatly, as there are many differences between the classes of trucks when it comes to specifications and capabilities. The higher the class of the truck, the more expensive it is likely to be.

Popular brands and models that are leased include:

- Ford Transit and Ford Transit Connect

- Ford F-150

- Ford Super Duty (F-250 to F-550)

- Chevrolet Silverado (1500 to 3500)

- RAM (1500 to 3500 HD)

- Kenworth T370

- Isuzu NPR & NQR

- Toyota Tundra

- Mitsubishi Fuso

- Freightliner M2106

- Peterbilt 567

- Mercedes-Benz Sprinter

- Hino M Series

Of course, there are many other brands and models of trucks that can be leased or purchased for your business. You should have a general idea of the type of truck you need before exploring your financing options.

Read Our Comprehensive Comparison of the Best Work Trucks, By Class >>

What Are Your Truck Leasing & Purchasing Options?

Purchasing Your Fleet of Trucks

If you purchase your fleet of commercial trucks, you can use cash or a loan. Paying in cash means your money will be tied up in your vehicles, but a loan means debt for the full amount of the vehicle will be reported on your balance sheet.

Purchasing gives you full ownership and control of the trucks, but you will be responsible for managing and paying for all maintenance and repairs. Since purchasing requires paying for the full cost of the vehicle, you will likely have higher monthly payments as compared to leasing.

Leasing Your Fleet of Trucks

Leasing trucks for your business keeps your fleet up to date and requires less upfront costs than purchasing. Many fleet leasing companies offer flexible terms, so you are sure to find an option that fits your needs.

Working with a fleet management company that offers truck leases can also give you access to services and benefits to help streamline your operations. These include but are not limited to:

- Custom Upfitting and Branding

- Nationwide Network for Maintenance and Repairs

- 24/7/365 Roadside Assistance

- Unlimited Mileage Options

Since no two businesses are alike, flexibility is one of the greatest benefits of leasing. Your financing and terms can usually be tailored to your exact business needs, and there are many options to start with. Here is a close look at a few of them:

Operating Lease

Operating lease payments can be deducted as an expense. With this lease, you assume no risks of ownership. At the end of the lease, you will be required to return the truck, but you may have the option of purchasing the vehicle at market value.

Terminal Rental Adjustment Clause (TRAC)

These leases are primarily applied to cars and light-duty trucks. Once a vehicle under a TRAC lease is sold, there is a final rental adjustment that could be an additional required amount or a credit to your account.

TRACs require a small down payment and monthly payments are often lower (and tax deductible!). Any changes in the market will not affect your contract.

Capital Lease

At the end of a capital lease, you will have the option to purchase the truck at a discounted price. The caveat is that you will assume some of the risks (and benefits) of ownership. The interest portion of this lease can be deducted.

Fair Market Value (FMV)

This leasing option is seen as an alternative to a fixed-price purchase, as it includes fixed monthly payments.

This option lets you choose to purchase the truck at the end of your lease terms. The purchase price will not be reflective of the truck’s current worth, and you will not know the purchase price in advance. Basically, you will not pay more than the truck is worth, but the lessor will not receive less than that either.

The 7 Biggest Benefits of Leasing Trucks for Business Use

1. Free Up Cash Flow

Leasing does not require up-front cash and there are many easy-to-arrange financing options available. This frees up your cash flow so that it can be invested in other opportunities that can produce a higher ROI for your business.

2. Reduce Losses from Depreciation

When you purchase a truck, its value depreciates as soon as it leaves the dealer’s lot. This is a huge risk for fleet managers, as it could lead to high losses upon sale if the vehicle is not held long enough.

On the other hand, leasing reduces depreciation loss. A fleet management company can purchase trucks at more affordable prices, so you do not have to worry about overpaying for new or used vehicles.

3. Take Advantage of Tax Benefits

In 2018, the IRS issued guidance under the Section 179 tax deduction that makes leasing sound like a no-brainer. This ruling allows businesses to deduct up to 100% of lease payments in the first year.

Tax laws can frequently change, and it is important to understand that lessors are better equipped to absorb these changes for your benefit.

4. Add Newer, More Efficient Trucks to Your Fleet

It seems that every year, major truck manufacturers release new models that boast countless productivity and efficiency benefits over their predecessors.

When you lease newer trucks for your business, you will be able to reap the benefits of the latest technology without worrying about trading in your outdated, depreciated models. Here are a few examples:

- Better Gas Mileage to Help You Save on Fuel Costs

Newer work trucks offer eco-friendly engines, various transmission types, and additional technologies to maximize your fuel spend.

- Less Worry About Wear and Tear

A work truck takes a beating. If you purchase your vehicles, you will be stuck with a worn down truck until you are able to sell it or trade it in for a new model. With leasing, you will be able to add a new model to your fleet as soon as your lease terms are over.

- Reduce the Impact of Age-Related Maintenance Issues

Since you will be adding new models to your fleet at the end of your lease terms, you mitigate the impact of breakdowns or non-preventative maintenance issues that are commonly seen in older vehicles.

- Manage Maintenance and Repairs

Leasing companies often offer maintenance programs that help you better manage and control your maintenance spending, including setting up reminders for routine maintenance intervals. This will give you peace of mind that your vehicles are routinely taken care of and running efficiently.

- Telematics & GPS Tracking Technology

Modern vehicles are equipped with technology that is intended to optimize usage. For example, telematics tools can help you assess drivers’ safety practices so that you can intervene if there are instances of excessive speeding or idling.

- Higher Driver Retention

Drivers prefer operating new trucks, which will aid in your retention and recruitment strategies.

5. Upfit and Brand Any Way You Need

The beauty of commercial trucks is their ability to be customized however your business needs. When you work with a leasing company, they will manage the upfitting process for you.

With upfit and branding services, the fleet leasing company will spec, design, work with vendors, and completely tailor each type of vehicle to the task. Some of the most common requests include:

- Designing and Adding Branded Decals and Vehicle Wraps

- Installing Storage Units, Toolboxes, Ladders, and Racks

- Setting Up Safety Features Like Back-Up Alarms, Spot Mirrors, and Exterior Lights

- Adding Ergonomic Features, Like Step Bumpers, Side Steps, Drop-Down Ladder Racks, and Grab Bars

Trucks That Can Be Upfitted

Whether you need a light-duty or heavy-duty pickup truck, Class 1 or Class 8, there is no limitation to the types of commercial trucks that can be leased, upfitted, and branded. Here is a quick look at some of the many professions that require custom upfitting:

- Roofing Contractors

- General Contractors

- HVAC Installers

- Plumbing Businesses

- Landscaping Businesses

- Field Service Technicians

- Pest Control

6. Use Technology to Improve Your Fleet Operations

As we mentioned with the newer truck models, technology has helped fleet managers utilize telematics — a tool that monitors vehicle system information, driver behavior, and trip data.

This technology combines tools like GPS trackers, sensors, and integrated communication systems to gather real-time and historic data relating to:

- Driver Behavior: Driving Speeds, Idle Time, Hours Tracking, Safety, etc.

- Vehicle Performance: Emissions, System Diagnostics, Maintenance Needs, etc.

- GPS Alerts: Accidents, Route Delays, Alternative Routes, etc.

With this information, fleet managers can better manage expenses, cut costs, and improve safety practices.

Read more about fleet telematics: Is Fleet Management Telematics Worth the Cost?

7. Have Peace of Mind About Your Maintenance & Repairs

Fleet management companies typically offer robust maintenance and repair programs. Depending on the type of lease you choose, some maintenance services may be included in your rate. The leasing company wants to ensure that their vehicles remain in good shape, and this will also minimize your downtime to keep your operations running smoothly.

Since you may not know where your drivers will be if an issue arises, make sure to partner with a leasing company that offers nationwide coverage and roadside assistance.

If you decide to purchase a work truck, be wary of used models. These have likely seen a lot of wear and tear, which means your maintenance costs will be high.

Leasing vs. Purchasing Example

To illustrate the costs of leasing vs. purchasing a work truck, below is an example using the price of a Ford F-150.

| Lease | Purchase | |

| Ford F-150 Manufacturer Invoice |

$38,725 |

$38,725 |

| Discounts or Rebates

(5% Discount + $1,500 Rebate) |

($6,400) | ($3,440) |

| Sales Tax (96% Paid Up Front) | N/A | 2,123 |

| Balance Subject to Lease Charge | $32,325 | $37,408 |

| Term |

36 Months |

36 Months |

| Monthly Payment (5% APR) | $611 | $1,124 |

| Sales Tax (6% of Payment) | $37 | N/A |

| Total Monthly Payment | $648 | $1,124 |

| Residual Value/Loan Balance at Maturity Date | $12,945 | $0 |

| Proceeds Realized | $12,945 | $12,300(5% Less Than Through a Leasing Company) |

| Tax Savings on Interest PV 5% (For Each 12 Mo. Period) | – | ($575)

(Total Interest Paid of $2,958) |

| Year 1 Tax Savings 100% Bonus Depreciation | – | ($7,473) |

| Year 3 Tax Due on Proceeds PV of 5% | – | $2,224 |

| 36 Payments Made PV of 5% | – | $37,659 |

| Total Proceeds Received PV of 5% | – | ($10,590) |

| Final Cost | $17,274

(21% Tax Rate PV 5%) |

$21,245 |

Disclaimer: There is no guarantee or offer to lease a vehicle for the reference prices used in this example. Consult your accountant and/or tax advisor regarding the actual benefits to you. Contact one of our leasing specialists to get a customized quote so you can make an informed decision.

–

Have any questions about leasing vs. purchasing your commercial trucks? Contact Merchants Fleet today to discuss the option that works best for your business.